SUSTAINABILITY REPORT 2019

CEFLA: CONTINUOUS IMPROVEMENT FOR VALUE ENHANCEMENT

“Creating value in time”.

This is the mission of Cefla Group and the spirit that fuels it towards future achievements every day – through product innovation, process evolution and the sharing of strategic approaches within its Business Units. Cefla pursues its mission with a view to continuous improvement through the relentless, purposeful and systematic search for value creation.

In carrying out its mission, Cefla Group adheres to its signature values ever since its foundation.

SUSTAINABILITY REPORT

| Patents | ||

|---|---|---|

| 2019 | 2018 | |

| Engineering | 2 | 3 |

| Shopfitting | 97 | 81 |

| Finishing | 274 | 273 |

| Medical Equipment |

315 | 286 |

| Lighting | 27 | 21 |

| 715 | 664 | |

| Design | ||

|---|---|---|

| 2019 | 2018 | |

| Engineering | 0 | 0 |

| Shopfitting | 8 | 12 |

| Finishing | 11 | 9 |

| Medical Equipment |

84 | 81 |

| Lighting | 6 | 5 |

| 109 | 107 | |

| Total | ||

|---|---|---|

| 2019 | 2018 | |

| Tot. patents | 715 | 664 |

| Tot. design | 109 | 107 |

| 824 | 771 | |

HUMAN CAPITAL

Cefla’s main focus is on human resources, since their expertise and skills grant a competitive leverage to companies operating in all sectors.

20% EMPLOYEES WORLD-WIDE

80% EMPLOYEES IN ITALY

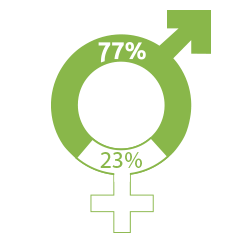

EMPLOYEES BY GENDER

HIRED ON AN OPEN-ENDED BASIS

TRAINING HOURS DELIVERED

IN ITALY: 31.399

IN OTHER COUNTRIES: 7.874

As a cooperative company, Cefla’s legal form clearly influences its HR policy. All Group companies are committed to providing their employees with a safe and healthy work environment, through the adoption of equipment, machinery and systems that comply with the safety requirements of the currently applicable legislation.

Personal care, training and professional growth, wage strategies and internal involvement are all key areas which were thought to be of considerable importance when the HR policy to be adopted by Cefla was defined and updated.

SHARE CAPITAL

The ability of an organisation to create value for itself is linked to the value that it creates for the other players in its target market. This value is determined by referring to a wide range of interactions, activities, relationships, causes and effects, in addition to those directly associated with changes in its financial capital.

In particular, Cefla’s approach to its corporate and relational capital depends on its ability to create and maintain solid relationships with members, customers and the community in general. All this with the aim of improving the well-being and competitive edge of the communities and background in which the Company lives and works.

OUTBOUND CONTRIBUTIONS >>> 33.382euro

INBOUND GRANTS >>> 193.055

TOTAL >>> 226.4372euro

3% COOPFOND

At the end of each year, Cefla pays 3% of its net income into the CoopFond mutuality fund.